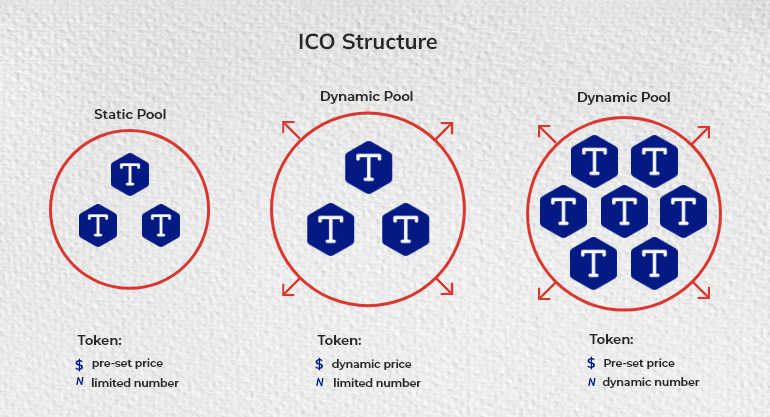

ICOs, or Initial Coin Offerings, are a popular means of acquiring capital for blockchain projects by selling digital assets. Crowdfunding can be done in-house or through an ICO services provider. In conventional fundraising, you may utilize a standard crowdfunding portal. However, when you launch an Initial Coin Offering (ICO), you sell specific digital assets that must be used on certain exchanges. The token value rises in direct proportion to the level of demand and growth for your enterprise. ICOs may be divided into two categories:

Types of ICOs

Private ICOs

A Private Initial Coin Offering, as the name implies, is a way to raise money from a small group of people. You also have the option of deciding on the amount of money a participant must put into your ICO before they can participate.

Public ICOs

A public Initial Coin Offering (PICO) is a variation on the ICO model, which is akin to an IPO. It’s a form of crowdfunding that aims to attract both large investors and the general public. There are several advantages to doing private ICOs rather than public ones due to regulatory concerns.

The Way ICO Fundraising Works

One must have a profound understanding of technology, economics, and the law to successfully launch an ICO. ICOs are all about using the decentralized networks of blockchain technology to put together and align the interests of diverse stakeholders in capital-raising operations. Here’s how ICO fundraising works:

Identifying Investment Options

A company’s objective to raise funds is always at the heart of an ICO. The firm selects the people it wants to reach with its fundraising campaign and prepares the resources it needs to do so.

Token Creation

Token generation is the next phase in the ICO process. Tokens on the blockchain are essentially digital representations of real-world assets or services. The tokens can be exchanged and fungible. There is no need to confuse them with cryptocurrencies, as the tokens are simply altered versions of current crypto coins. Tokens, as opposed to stocks, do not often entitle the holder to a share of a company’s profits. Rather than that, the majority of tokens provide their holders with a stake in the company.

Specified blockchain platforms are used to produce the tokens. Tokens are easier to create than a new coin since a corporation does not need to build the code from start. Instead, the tokens may be created on current blockchain systems, such as Ethereum, by making simple code tweaks.

Promotional Campaign

Promotional campaigns are also common for companies in order to draw in new customers and shareholders. The initiatives are often conducted online in order to reach the biggest possible audience. However, the promotion of ICOs is now prohibited on numerous prominent web platforms, like as Google and Facebook.

Read Also: A Complete Guide To NFT Marketplace Development

The Initial Product

After the tokens are created, they are made available to investors for purchase. It is possible to organize the selling into many rounds. Once the ICO is over, the firm may use the funds to develop a new product or service, and investors can either utilize the tokens they purchased or wait for the tokens’ value to grow.

An Overview Of ICO Regulations, Laws, And Standards

In the realm of money and technology, ICO is a completely new concept. Since ICOs were introduced, capital-raising procedures have changed significantly. Regulators throughout the world, however, were not ready for the advent of the new fundraising model in the financial sector.

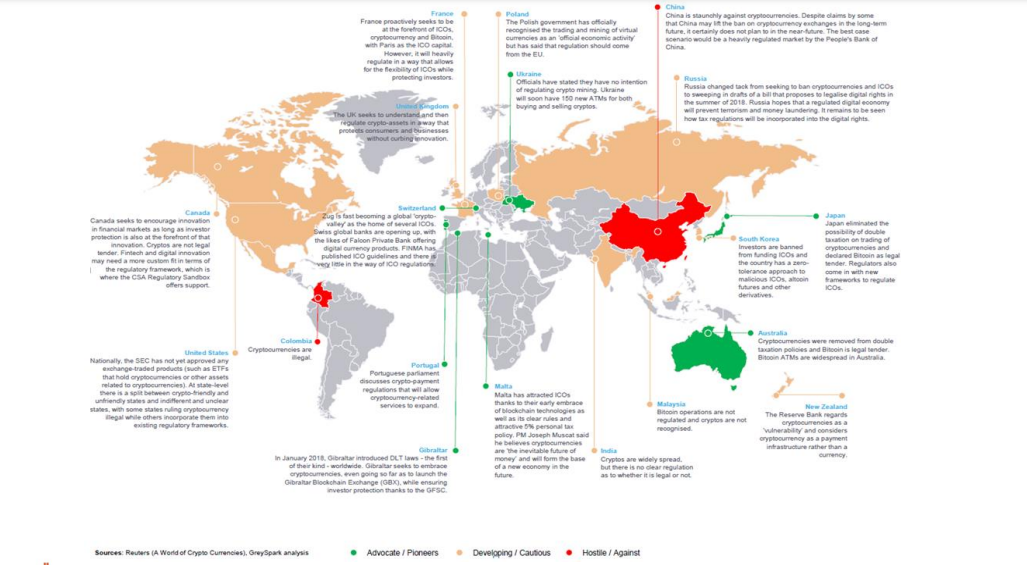

Varied nations have different policies and approaches to regulating ICOs. ICOs are illegal in South Korea and China, for example. A number of nations in Europe and North America, including the United States and Canada, are working on ICO rules.

There are already published standards for ICOs in certain countries such as the UAE, Hong Kong SAR, and Australia. The methods used in different jurisdictions can be quite different; therefore it’s important to familiarize yourself with your specific situation thoroughly or to consult with legal experts who have extensive knowledge in this area.

What Is An ICO Whitepaper, And Why Is It Important?

Many variables come into play while trying to build an ICO. A whitepaper is a must-have. As a main public communication tool, this paper serves as a primary source of information for your stakeholders.

Whitepapers are used to outline the project’s elements, mission/vision, objectives, target audience, planned funds usage, roadmap, significant milestones, the team, the timeline for a public offering, and other practical information. It is important to remember that a whitepaper is a business document, not an essay or research paper. Obviously, if we’re talking about ICOs for IT firms, this business plan contains details of your project’s technologies. However, ICO development isn’t only for technological initiatives; it’s also utilized by a wide variety of businesses to raise money.

This business document is critical if you intend to execute an ICO, as the coin offering begins the minute it is published by the corporation. Your project’s website or an ICO listing site might be a good place to put it. A whitepaper’s primary objective is to promote your token and provide crucial details to potential investors.

However, a whitepaper isn’t the only method to communicate your startup’s vision to potential investors and customers. In order to get the most out of this whitepaper, it’s a good idea to select an ICO development company with a proven track record. The goal of a whitepaper is to persuade potential investors to believe in you and your business.

The fact that there are no standardized formats for this document and whitepaper, which are released freely without legal or exchange-related obligation, means that issuing companies typically do not divulge much information like their contact information. Moreover, the blueprint’s substance and structure are different because there is no active underwriter or investor roadshow.

No matter if you decide to hire whitepaper development expertise or design your own ICO business plan, you need to weigh the benefits and drawbacks of both options before making a final decision.

The Pros And Cons Of ICOs

Benefits

Anyone Can Purchase Tokens

In contrast to a large-scale IPO, a token launch differs from the sale of shares. Under the Securities Exchange Act of 1934, an Initial Public Offering (IPO) is subject to a wide range of restrictions. The selling of digital keys can be linked to a token-launching event. Participation in an IPO is normally restricted to accredited investors with a net worth of at least $1 million. However, because most ICO purchases are anonymous, tokens sold in an ICO can be sold to anybody.

Tokens Can Be Sold Worldwide

An ICO allows investors from all around the world to participate in the creation of new currency. Most of the time, converting digital money into project coin offers is a worldwide effort. Assuming a bank account receives a large number of money transfers in a short period of time, it is possible that assets would be frozen. Token sales financed by digital cryptocurrency, on the other hand, are always available.

The Liquidity Premium In The Token Economy

Tokens that are sold in an ICO have value. In a global, round-the-clock economy, this value may be freely exchanged. The equity in an IPO is nothing like this. When an IPO becomes public, it might take a decade or more for investors to be able to withdraw. Tokens, on the other hand, may be sold in a matter of minutes.

Reduced Entry Obstacles

For many tech-driven IPOs, Silicon Valley is the place to be. Wall Street is “the place to be” for comparing financial products. Token launches, on the other hand, can take place anywhere in the globe, therefore this need is considerably reduced.

An Immediate Purchase Option

A barrier or intermediary does not exist between buyers and sellers of cryptocurrencies. You may immediately sell your coin on the cryptocurrency market as soon as you make it.

This allows for a quick and efficient investment procedure for both firms and investors. With IPO, the procedure of purchasing shares is labor-intensive. Once you have the right currency, all you have to do is sit back and wait for the ICO to start.

Drawbacks

Volatile

A variety of blockchain technologies, as well as a variety of ICOs competing on the market, make them vulnerable to change. For investors, quick price swings in their asset might be thrilling or chaotic, depending on the number of factors that can affect its present worth.

A Risk Of Fraud

As an investor, you must thoroughly review the team members’ bios and determine if they have the expertise, technology, or blockchain understanding to back up their promises in the whitepaper. This is a significant fraud of an ICO. It’s true that not every investor has the knowledge and experience necessary to tell the difference between an honest and legit ICO.

There are several ICOs that don’t have to go through the same regulations as IPOs and other conventional assets. While this makes them more accessible and affordable, it also leaves them more open to fraud and other harmful practices, which may essentially let illicit organizations steal money from unsuspecting investors.

Possibly Lacks Accountability

Start-up enterprises and other private entities are often the sources of many Initial Coin Offerings (ICOs). There is no assurance that these firms will be able to deliver on their promises, thus investors may not always get what they want, even though they might expect substantial returns on investment in the future.

A Step-By-Step Guide To Launching And Growing An Initial Coin Offering

Anyone who plans to conduct an ICO hopes that the procedure will be a success. In order to do this, the following procedures must be followed:

Analysis And Planning For An ICO

If a firm decides to go through with an ICO, it must first conduct a comprehensive analysis of its business strategy. Experts in the market assess the idea’s viability and practicality in order to determine whether or not it has the potential to bring in investors. Also, before beginning the ICO, it is vital to consider the possibilities of using Blockchain to implement the company concept.

Besides Blockchain, there are a number of additional technological elements and criteria that must be taken into consideration. The firm that launches or develops the ICO then offers the concept to the market via numerous venues to gauge investor interest in the enterprise. The ICO concept is reworked and regenerated based on constructive and critical input.

Assembling Of A White Paper

The next step after coming up with an ICO concept is writing the Whitepaper reports. For the successful launch and development of an ICO, a well-written and authentic whitepaper is a critical component. An ICO’s legitimacy is built on the credibility of its whitepaper. Therefore, employing a professional ICO development business, which not only provides valuable tactics but also assists in the preparation of whitepaper reports, is a good option.

Designing An ICO’s App

An ICO launch app that is user-friendly and easy to use is another aspect that should not be overlooked. ICOs are more likely to attract investors if they have an app that provides useful and persuasive information. Designing and creating an ICO app should be done by mobile app development business that has expertise in user experience/user interface (UX/UI) design.

Promotional Services For Pre-ICOs

ICO development is essential, but it is crucial to market and publicize it on relevant and appropriate platforms. If people don’t know about your ICO website, it’s pointless. The ICO launch and development process necessitates the use of digital platforms like LinkedIn, YouTube, and others to market the ICO launch website.

Evaluation And Development Of ICO Tokens

As far as ICO applications and tokens are concerned, Ethereum dApp development appears to be the ideal platform for ICO launch and expansion. Many organizations prefer to host their ICOs on Ethereum because of its smart contracts and ERC-20 token features. Ethereum not only makes it easy to build decentralized applications (dApps) on its platform, but it also makes it possible to create ICOs. The use of Hyperledger Fabric smart contracts and the FabToken to create ICO tokens is also a viable option.

Development Of Smart Contracts

In order to initiate and develop an ICO, a dApp would need to incorporate intricate business logic for tokens using smart contracts. Automated smart contracts are used in the blockchain to assure trustworthiness and transparency.

Wallet Development For Cryptocurrency

Investing in an ICO necessitates a significant amount of cryptocurrency trading. Cryptocurrency wallets are essential for registering the transactions of ICO tokens and ICO currencies. Invest in a cryptocurrency wallet developer firm that specializes in developing wallets for the cryptocurrency market.

Read Also: A Comprehensive Guide For EWallet Application Development

Post ICO Assistance

Token sales and exchanges begin once the ICO has been launched and developed. ICO tokens and coins can be exchanged for fiat currency by investors.

Platforms For Cryptocurrency Exchange

ICO tokens or ICO coins must be listed on numerous cryptocurrency exchange websites as part of the ICO debut and development in order to facilitate trade.

Read Also: Looking To Create Your Own Cryptocurrency Exchange App? Here’s The Ultimate Guide

Promoting ICOs And Helping The Community

For the most successful ICO development, you must effectively market your company and obtain community support. Things to bear in mind are as follows:

- To run an online business, it is essential to have a presence on social media sites such as LinkedIn or Twitter, especially decentralized ones.

- In order to attract tech-savvy investors, you must be active on Reddit, blockchain, and DeFi communities such as BitcoinTalk.

- Moreover, there are conferences, fairs, and interviews at which you may showcase your ICO. Make use of this opportunity to build relationships with ICO development teams by attending these events.

What Does It Cost To Develop An Initial Coin Offering (ICO)?

Factors Affecting The Value Of An Initial Coin Offering

The Project’s Complexity

The intricacy of the project will determine the total cost of conducting an ICO event. It’s worth noting that, as the number of features increases, so does the associated cost.

Timeline Of The Project

It will take a great amount of time to launch a fully secure and legal ICO. The professionals on the core team who are participating in the project also have a role in determining the launch date. As a result, a project’s budget is heavily influenced by its completion date.

Ideation Of An ICO

When it comes to dealing with technologically sound procedures, ideation is the center of the storm. First, it is vital to set aside a portion of the project’s budget to ensure that it is financially viable. However, despite the fact that ideation doesn’t cost much the process typically depends on the intricacy of the project as previously described.

Technical Design

Implementing an appropriate architectural framework is the following stage when ideation is complete. The architectural framework plays a significant role because the majority of the development costs will be focused on the technological parts of the project.

An ICO’s Launching Cost

ICOs are becoming more and more popular with each passing day in the crypto community. They have become the most popular technique of raising money. Businesses of all sizes can expect to pay a significant amount of money to establish a new method of monetization once it becomes common place.

When it comes to ICO events, the cost is never fixed. An ICO script’s features and properties will have varying prices. This variant will be depending on the subsidiary features that have been introduced. An ICO’s success will also be heavily influenced by the complexity of implementing several unique features. Additional elements that have been integrated within the ICO script will determine this range.

As a result, it is fair to assume that a fully operating ICO will cost between $5,000 and $14,000.

while keeping the app design simple, so it can be used by all the crypto traders.

However, to give a rough estimate, after considering the app features, number of platforms, region of the mobile app development company, and the expertise and experience of the app development team, the average cost to create a crypto exchange app could be somewhere between $5000-$25000.

The expense of producing an ICO script will be regarded as beneficial if the procedure is completed in a timely and professional manner. An ICO script is only as excellent as the quality of the developer. You must entrust the development process to someone who is capable of handling it.

Conclusion

We’ve seen that the popularity of ICOs is steadily increasing. Although ICOs are a relatively new idea and some have expressed worries about the real worth of the tokens, they have quickly become one of the most popular methods of acquiring capital in the modern era. We really hope that this post has given you a new perspective on the Initial Coin Offering (ICO).