The finance world is experiencing an unprecedented change, and new technologies are now changing how people interact with money. Two broad categories have now evolved in this arena, Centralized Finance (CeFi) and Decentralized Finance (DeFi). The principles behind both systems are different, both are trying to streamline financial transactions and make it easier for people to access digital money.

In this blog post, we are going to discuss DeFi vs CeFi, to help you understand the characteristics, differences, and the extraordinary possibilities of both. Also, if you’re looking to get a deep understanding of defi crypto, or how centralized cryptocurrency infrastructure works, then this guide is for you.

What is DeFi?

DeFi is an abbreviation for decentralized finance, an innovative financial system that is built on blockchain technology. It removes banks and brokers that act as middlemen, and allows peer to peer transactions via decentralized applications (dApps). These applications are executed on smart contracts which offer transparency and eliminate the need for trust in third parties.

Features of DeFi

>Decentralization Blockchain

Unlike other finance systems, DeFi runs on the decentralization blockchain which allows a central authority to act as the system’s vice. Decentralized finance isn’t dependent on centralized servers or authorities making it secure, transparent and censorship resistant.

>Decentralized Wallets

Funds are stored in decentralized wallets such as MetaMask, or hardware wallets. What’s great about these wallets is that they give you full control of assets, and you get rid of intermediaries unlike what’s on centralized finance platforms and custodial services. You may get a detailed understanding of these solutions through an e-wallet app development company.

>Transparency

DeFi makes sure that all transactions are stored on a public blockchain. This transparency brings the idea that users can verify operations happening on crypto decentralized exchanges, lending protocols or any DeFi application, instilling confidence in the system.

>Global Accessibility

Anyone can access DeFi platforms with only an internet connection, creating financial inclusion. These systems give power to people in areas where conventional banking or centralised banking is not available or is unreliable.

>Smart Contracts

Operations like dex trading, loans and insurance are automated by smart contracts. These self-executing agreements reduce the need for manual processes and are the backbone of defi crypto ecosystems like the best decentralized exchange options.

Explore More: Ultimate Guide To Develop A Cryptocurrency Exchange App Like Binance

Examples of DeFi

- dYdX Exchange: dYdX is well known for its DeFi trading platforms, with the ability to do margin trading without any intermediaries.

- Uniswap: The world’s leading decentralized exchange cryptocurrency that enables token swaps.

- Aave: A protocol where users can borrow and lend digital assets.

- MCDEX Exchange: A decentralized derivatives trading application built on DeFi.

- Top Decentralized Exchanges: In the list of decentralized exchanges, we have platforms such as SushiSwap, PancakeSwap, and Curve Finance.

What is CeFi?

Traditional financial services that run in a controlled and regulated environment are called CeFi, or centralized finance. Here centralized cryptocurrencies and platforms rely on intermediaries like banks, exchanges or financial institutions.

Features of CeFi

1.Custodial Services

CeFi platforms provide custodial wallets, with which users hand over ownership of their funds safely into the platforms’ custody/model. Usage is simplified, as customers don’t have to manage private keys, unlike in decentralized finance where customers have to manage decentralized wallets.

2. Ease of Use

User friendly interface and 24/7 customer support, make CeFi platforms more accessible for a newbie. Unlike crypto decentralized exchanges, these platforms are designed with a focus of intuitive designs and ease of use toward a better onboarding experience.

3.Regulation Compliance

CeFi is a regulated environment, which takes care of your funds so you do not have to worry about whether or not your money is safe. A clear example of this structured approach to dealing with centralized cryptocurrencies and fiat integrations is found in marketplaces such as Coinbase and Kraken.

4. Fiat Onboarding

CeFi platforms enable you to convert fiat into crypto, bridging traditional finance and crypto. While DeFi protocols typically revolve around crypto, the CeFi platform provides the chance to buy and sell through regular money, for example, USD or EUR.

Explore More: Blockchain Platforms for Web3 dApp Development in 2024

5. Centralized Wallets

In CeFi, funds are stored in centralized wallets that are very convenient but at the expense of user control. However, this is different from the autonomy of a decentralized wallet used in dex crypto apps.

6. Diverse Services

CeFi covers everything from lending and staking, to crypto investment opportunities. Centralized crypto exchanges, like Binance and Kraken, are platform innovators that are always looking for ways to improve the user experience.

Examples of CeFi

- Coinbase: A highly popular centralized exchange that makes it easy for people to buy and sell crypto.

- Binance: It offers a centralized crypto platform as well as a dex crypto exchange.

- Kraken: Known for its compliance and security when managing centralized cryptocurrencies.

- Fed Digital Currency: Government digital initiatives can include centralized projects such as the fed cryptocurrency.

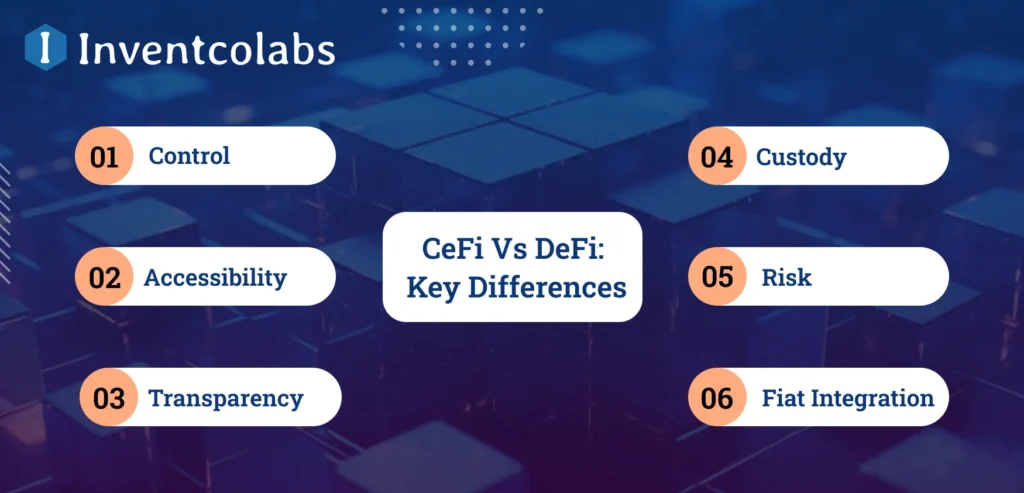

CeFi Vs DeFi: Key Differences

>Control

DeFi, the trustless system, is driven by smart contracts and blockchain and has no intermediaries. A decentralized wallet allows users to interact directly with protocols and retain total control of their assets. On the other hand, you have CeFi, where banks or centralized crypto exchanges keep the money and conduct its transactions. This provides CeFi platforms a more structured environment but at the same time users need to put their trust in these third parties with their funds.

>Accessibility

Financial inclusion is promoted by DeFi as it makes its services available globally through decentralized exchange crypto platforms. DeFi apps like dex trading or lending protocols have no restrictions like KYC or AML requirements that means anyone with internet access can use them. Meanwhile, CeFi platforms are regulated, and thus access requires user verification. With the help of a professional cryptocurrency app development company you can leverage CeFi to make it easy to access centralized cryptocurrency systems but restricts access in some areas or to those who don’t have the right documentation

>Transparency

All DeFi transactions are recorded on a public blockchain, where they can be transparent and traceable. Users do not depend on centralized oversight to verify activity across platforms such as Uniswap or other DeFi platforms. However, CeFi works within a closed infrastructure. In centralized finance, transparency is based on the institution wanting to disclose data, thus lowering verifiability. Openness is good for DeFi, but it means that data is exposed to scrutiny, unlike the privacy in CeFi.

>Custody

Unlike centralized exchanges, the funds are under full control of DeFi users, and don’t require the use of third parties due to decentralized wallets like MetaMask or Ledger. On CeFi platforms, like centralized crypto exchanges, user funds are stored by the platform itself, in centralized wallets. CeFi is user friendly with this custodial model, but this brings risks like mismanagement or hacking. In DeFi, users own their private keys, making it more secure, but more responsible.

Read More: How to Develop a Blockchain App: Tech and Business Guide 2024

>Risk

New risks that DeFi comes with, are bugs in DeFi protocols, smart contract vulnerabilities and scams. Because there’s no regulation in place, if something does happen in DeFi trading or lending, you have no recourse. Although more secure since it’s overseen, CeFi is susceptible to centralized mismanagement and cyber attacks. Centralized finance users expect institutions to protect their funds, while history has proven that breaches or collapses (for example, exchange failures) can result in major losses.

>Fiat Integration

Fiat transactions are limited on DeFi platforms, they mainly operate with decentralized currency and cryptocurrencies, such as Ethereum. Most users rely on a third party service that converts fiat to crypto before accessing defi trading platforms. CeFi is great at integrating fiat, and you are able to deposit and withdraw digital and traditional currencies. Therefore, CeFi is the preferred choice for newcomers in the crypto market because it is easy to use, bridging traditional finance with the world of digital money currency.

>Use Cases

The best known use cases of DeFi are staking, lending, and operating decentralized exchanges list like MCDEX Exchange, dYdX Exchange, etc. Automation and transparency are what these services thrive on. However, CeFi shines in offering structured services like fiat onboarding, trading with centralized crypto exchanges and access to institutional grade financial products. DeFi projects are appealing to those that are tech savvy, while CeFi is simpler and has better customer service.

Conclusion

While the DeFi vs CeFi debate is real, it also features the greater changes occurring in the financial industry. Both approaches have their pros and cons and favour different user needs. Being transparent and decentralized, DeFi is shaping the future of finance and CeFi is a bridge for traditional users to enter the world of the digital asset ecosystem. Technology is only improving with time, and it’s possible these two systems will fuse together and allow for some sort of hybrid solution that combines the best of both worlds.

FAQs

Q1.How do DeFi protocols work?

ANS. Smart contracts allow DeFi protocols to automate things such as lending, staking and dex trading on platforms like dydx exchange and MCDEX Exchange.

Q2. What is the risk of DeFi and CeFI?

ANS. The risk DeFi poses are smart contract bugs and lack of regulation whereas CeFi poses risk of centralized mismanagement and hacks.

Q3. How does DeFi make money?

ANS. Transaction fees, platform usage fees, and yields from liquidity pools in platforms like dydx exchange, MCDEX Exchange are how DeFi platforms make money.

Quick Contact Us

Call/whatsapp : +1-646-480-0280

Email : jiten@inventcolabs.com