Finding the appropriate app developer to create your loan lending app may seem impossible when you need to know what to look for during this process. Experience in app creation is key here; someone with this specialization must know how to design something appealing that also functions well. Charging reasonable rates within your budget and timeframe is also essential.

This is a brief outline of the costs of creating an application like this one, including typical features.

Loan lending app development cost will depend on your requirements and needs; pricing for loan lending app development varies, whether that means designing for Android, iOS, or Material Design apps.

If you want to develop an Android application using Material Design, for instance, you will need to work alongside experienced programmers who can assist in the process and ensure that your loan lending application runs seamlessly.

Let’s examine the costs associated with developing and publishing an app to an app store, as this depends on your desired loan lending app type.

An average loan-lending app design typically costs between $10,000 and $12,000, depending on its target device (iOS or Android), and development runs between $12,000 and $20k, depending on the platform.

Many are curious to understand the cost of developing loan lending apps as their business becomes more well-known.

Before reading this blog post, let’s review some key statistics that can help us understand current market trends. In addition, this section will discuss the costs of developing loan lending apps.

Key Statistics of Loan Lending App Development .Some of the most significant data on loan applications for lending are:

- More than 30% of bankers online use their loans at least once per month.

- FinTech’s technology has grown so big that it is now taking over traditional lending. It is the biggest source of personal loans across the U.S.

- The market for digital lending platforms is projected to reach $20.5 billion by 2028, with an anticipated annual growth rate of 24% globally from 2021 to 2028.

This blog will cover everything related to bespoke loan lending app development. Let’s jump straight to the details.

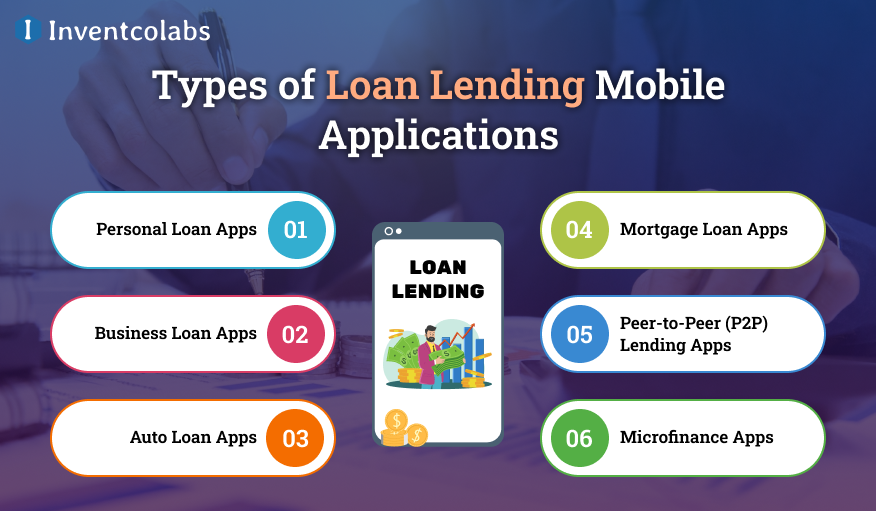

Types of Loan Lending Mobile Applications

Here are some of the most difficult and lucrative mobile lending apps you can begin with. There are various loan lending mobile applications that you can also choose to earn a profit. However, these six lending apps will yield the highest profits.

>Personal Loan Apps

These apps cater to people looking for financial help to meet personal requirements, such as educational expenses, medical bills, or travel expenses. Users can request loans, monitor repayments, and track their personal finances using these applications.

>Business Loan Apps

Designed for entrepreneurs and small-business owners, these on-demand applications facilitate financing expansion of your business, working capital, and other financial needs. They typically offer specialized features such as fast approval, flexible repayment options, and financial tools geared toward businesses.

>Auto Loan Apps

Ideal for those seeking a loan to purchase a car, Auto loan applications simplify the application process and approval. Users can research various loan options, calculate interest rates, and then submit the required documents for an effortless car financing experience.

>Mortgage Loan Apps

Mortgage applications simplify the process of getting home loans for those who want to purchase or refinance a house. They typically provide tools for estimating the mortgage rate, monitoring the status of applications, and handling documents efficiently.

>Peer-to-Peer (P2P) Lending Apps

P2P lending applications let borrowers connect directly to individual lenders, creating an open lending platform. Customers can take out loans or invest funds, often with higher flexibility than banks, developing the concept of lending through a community-driven model.

>Microfinance Apps

In search of people in need of small-scale financial aid, Microfinance apps provide microloans that help entrepreneurs and individuals living in emerging economies. They typically concentrate on financial inclusion, offering credit access for those who might not have traditional banking connections.

Explore More: Loan Lending Mobile Application Development – Complete Guide

Features Needed to Develop A Loan Lending App

In the constantly evolving technology of financial services, constructing a loan lending application requires a well-planned mix of novel features to provide the user with a smooth experience. Here are the essential components discussed by a Loan Lending App Solutions company.

>User-friendly Interface

An intuitive and simple user interface is vital for any loan application. Ensure that users can easily guide through the app and that applying for a loan is simple.

>Secure Authentication

Use robust authentication systems to protect your user’s information and ensure the trustworthiness of your app. Two-factor authentication is an excellent example of how to provide an additional level of protection.

>Credit Scoring and Risk Assessment

Incorporate credit score and risk analysis techniques to determine a borrower’s creditworthiness. This ensures the responsible conduct of lending and minimizes the chance of default.

>Document Verification

Allow users to upload documents securely. According to the mobile application development firm, you must implement an authentication process that authenticates the information provided, thus reducing the chance of fraud.

>Loan Calculators

Give users tools for calculating loan amounts, including interest rates, loan amounts, and repayment plans. Displaying this information transparently helps customers make informed choices.

>Notification and Alerts

With push notifications and alerts, users will be up-to-date on the status of their applications’ future payments due and any other important updates.

>Electronic Signatures

Allow users to sign loans electronically, easing the approval process while reducing the amount of paperwork. Therefore, consult experts on including these features when hiring a mobile app development company.

>Payment Gateway

Integration Integrate a safe and reliable payment gateway to facilitate smooth transactions. Numerous payment options and automated options can improve user convenience, improving the trustworthiness of the P2P lending application development project.

>Customer Support

Integrate a robust customer service system that includes chatbots and live assistance to respond to customer queries quickly.

>Regulatory Compliance

Check that your app is compliant with the regulations governing financial transactions in your intended market. This includes laws on data protection and other regulations that are relevant to establishing confidence among users. These are a few of the essential features needed to create an app for loan lending that will bring more profits and success for your company after you have a better understanding of the features that can be incorporated into the development of loan lending apps and how to go about the process of developing an app.

Explore More: Top Reasons To Have A Mobile App For Your Business

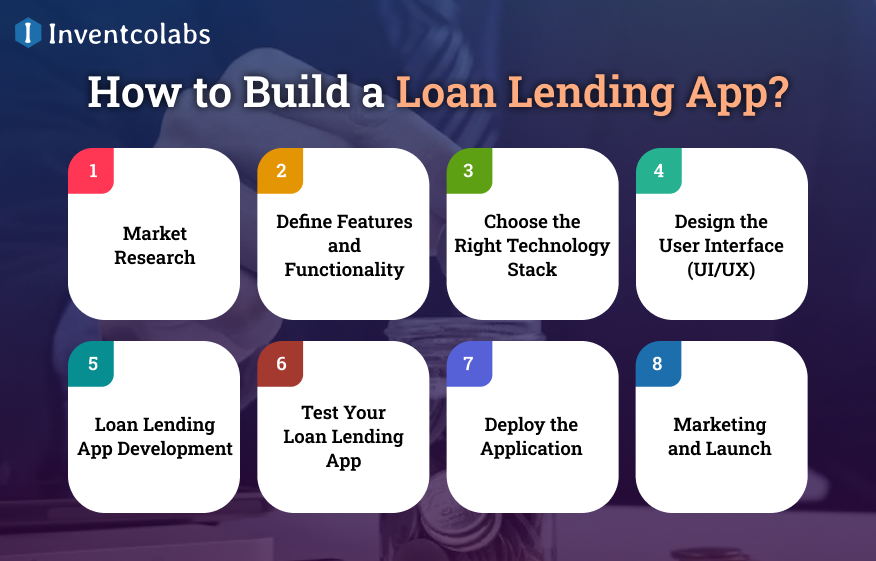

How to Build a Loan Lending App?

Making a loan-lending app involves several factors and steps that must be taken to ensure security, functionality, and user-friendliness. This is a comprehensive guide to how to build one:

>Market Research

Conduct a market analysis to identify the audience you want to reach, competitors, and regulatory needs. Determine the most distinctive advantages of your application.

>Define Features and Functionality

Based on the research findings, define your app’s capabilities and features. Prioritize the most essential features to be included at the beginning of development.

>Choose the Right Technology Stack

Select the best technology stack based on the app’s scalability and security requirements.

>Design the User Interface (UI/UX)

Create a user-friendly and intuitive interface. Take note of design elements that improve the user experience and simplify applying for loans.

>Loan Lending App Development

Focus on the core features first when developing the app. Implement security measures, connect APIs for credit scoring, and ensure seamless data flows. If you aren’t familiar with the technical aspects of the development process, seek help with loan app development from professionals.

>Test Your Loan Lending App

Conduct thorough testing to discover the bugs and glitches that must be fixed. Execute usability tests to ensure that the application meets users’ expectations.

>Deploy the Application

After thorough testing and quality control, the app will be ready for release and deployment on your chosen platform (iOS, Android, or both). Depending on your platform preference, you can engage Android app developers or iOS app developers.

>Marketing and Launch

Create a marketing strategy to advertise the loan lending app. Use social media, digital channels, and partnerships to generate awareness.

It’s a straightforward step-by-step procedure for loan lending mobile application development. Follow these steps to help you construct the perfect business app.

Read More: Top Money Lending Applications in the USA and Why People Use them in 2024

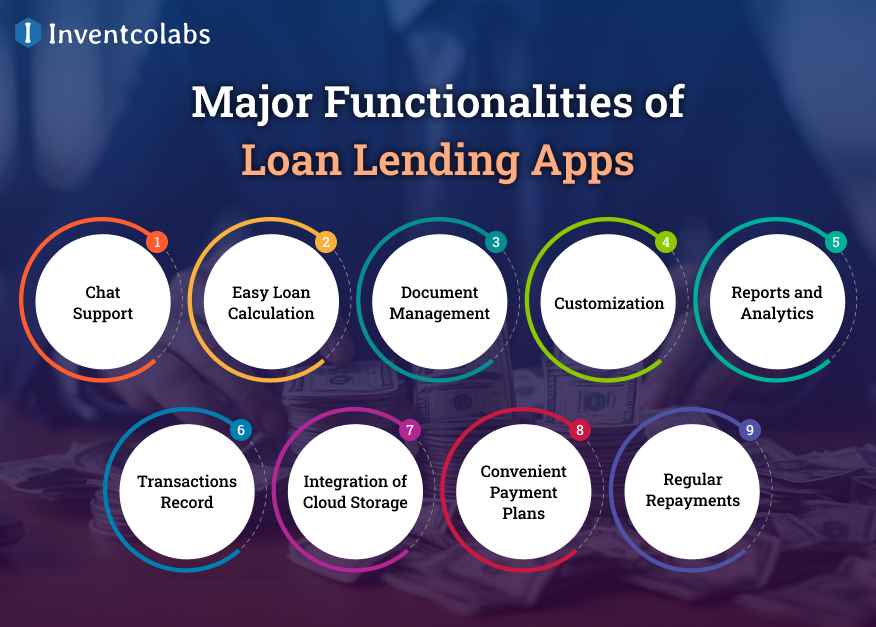

Major Functionalities of Loan Lending Apps

Certain crucial factors must be considered when you wish to prevent the loan you are applying for from being merged with other products on the market for loan lending. While each loan application is unique, specific characteristics are common to all.

Remember these aspects throughout your mobile app for loan lending creation in the Los Angeles process, regardless of the industry or issue it addresses.

>Chat Support

Although lending applications are effective at removing the requirement to have a direct conversation with a person who is a clerk, customers will likely still require assistance. Also, a live chat option with your representatives could be a great way to manage these issues.

>Easy Loan Calculation

Your lending application should include the ability to calculate your loan. Don’t leave it up to your customers to calculate their loans since they will likely be novices in lending. Include a calculator that can assist users in calculating the data related to loans.

Customers must be able to comprehend the essential information about their loans by using the loan application, such as the interest rate, the amount of monthly payments, and any other relevant information.

>Document Management

It should be easy for users to organize their documents within the app. They can delete or upload files as needed.

Customization Because they utilize the device’s native features and a user interface (UI) design, custom mobile apps offer customers the most enjoyable experience. Customized loan apps function similarly.

Be cautious to follow a different style. The best loan lending applications are well-designed and focus on the smallest details. While they might appear insignificant, they significantly affect how customers consider your company’s image.

>Reports and Analytics

Provide administrators with comprehensive reports that provide in-depth analysis to increase productivity. The total amount borrowed during an exact period of time and the amount returned over the same period are both available to the administrator.

>Transactions Record

When a loan has been approved, customers should be able to monitor and complete all outstanding payments. It is essential to quickly determine the amount due.

>Integration of Cloud Storage

Integrating cloud technology will greatly benefit the app since there are many requirements regarding user data privacy. This feature will ensure the security and confidentiality of users’ information.

>Convenient Payment Plans

Customers can benefit from this vital function by reducing their monthly payments to the amount they borrowed from the approved loan. They can manage the net amount they pay due to this feature.

>Regular Repayments

By enabling this feature, it is possible to deduct loan EMIs from the borrowers’ accounts automatically. In addition, this stops lenders from not making all loan payments.

Read More: Money Lending App Development Cost, Types, Tech Stack, And Features in 2024

Cost of Creating Loan Lending App

What is the cost of developing an app for loans? What budget is needed to create a fintech app to obtain a loan? Our experts have addressed the question for you.

Loan Lending App Development could cost anything from $50,000 to $200,000. It varies based on the degree of complexity and amount of features you’d like to have. The development costs for your lending application might decrease if you research and purchase SDKs for software development (SDKs). Many factors determine how much money it will cost to develop a mobile application designed for lending. The company that develops the app chose to create the loan application, which will significantly influence the total development cost. The following are the four most essential elements:

- App’s complexity

- App store

- UI/UX

- The time it took to create the application

Read More: How Much Does It Cost to Create a Real Estate Mobile App?

How Much Will It Cost to Create a Loan Lending Application?

Many factors can alter the cost of a loan application. What exactly is the significance of these elements? In this article, we’ll look at some particular aspects.

Developer’s Geographical Origin

Location is one of the main elements that could affect the price of establishing a loan-lending application. This table highlights this issue:

- North America- $80,000 to $150,000

- South America- $50,000 to $100,000

- Europe- $55,000 to $95,000

- Africa- $40,000 to $60,000

- Asia- $35,000 to $75,000

The Expense and Complicatedness of a Loan-Processing App

The difficulty of the loan-lending app concept will impact how much money is allocated to the SDLC budget. It’s simple: you’ll require more money to design a more complex solution.

Therefore, deciding what you can afford to develop a loan application is helpful. Also, decide on the return you’ll get from it after you have made it. Ensure you can organize your technology stack, features, and other features from the information.

Here’s an approximate amount of money you can budget to purchase your SDLC. This is a rough estimate of the cost of SDLC.

- Simple Lending App Development Cost: $50,000 to $80,000

- Average Loan Giving App Development Cost: $80,000 to $250,000

- Complex Loan App Development Cost: $350,000

Explore More: How To Develop An App Like TurboTax : Cost & Features

The Developer’s Perspective on How Much It Would Cost to Create a Loan-Sharing App

Contact a Loan Lending App Development Company that creates apps for demand if you want to develop a loan application. Therefore, the cost of hiring a professional developer can be pretty dependent on how skilled they are. This is because one factor can affect the price of completing a loan application.

This is a rough estimate of how much it will cost to hire dedicated developers with different experiences in Flutter. Then, we’ll discuss the various ways to employ people and the associated costs.

- Senior app developer: $30 to $40 an hour

- Middle app developer: $20 to $30/hour

- Junior App Developers: $15-$20 per hour

Conclusion

The apps for money lending are thriving, and if there needs to be more apps, there is a chance for startups to invest funds into the market. Suppose you plan to develop a money lending application by yourself. In that case, there is an opportunity to stand out from other apps and beat the race as consumers slowly transition from bank loans to readily accessible loans through these apps. You only need to recruit an expert team to develop the app, which will take your ideas and develop them using the latest technologies and features.