When borrowing money, it is possible to obtain it at any bank. They can lend you substantial money at a particular interest rate or even offer you credit cards for your everyday use. In any case, many users often use these efficient services.

Previously, you were required to visit the bank, wait in line to fill out various forms, supply financial documentation, etc.

It was also a complete waste of time and could have been more convenient; however, people were left with the option of doing it. But today, there are various options for those who want to take out loans.

Apps for money lending have made it possible to loan money easily by sitting at home. These apps are currently top-rated across the entire FinTech world.

Loan Lending App Development is now a profit offer in mobile application development.

Money Lending App Development

Most money lending happens via P2P lending, which is “peer-to-peer lending.” It is the process of granting and receiving loans by specific individuals without the involvement of traditional financial institutions, such as an intermediary.

Peer2Peer lending can be done with the help of a particular P2P lending program, often referred to as an app for money lending that allows users to be lenders and borrowers. They are referred to as loan or Loan Lending App Development.

Most of the credit or loans issued through these processes are handled in the name of private persons. Companies can also participate as a group in these processes in a few instances. P2P loan rates can be fixed or given through reverse auction.

In the event of a reverse auction, potential customers of the money will decide on the maximum amount of interest at which they would like to obtain a loan, together with potential creditors who negotiate against each other to offer the funds at a lower cost.

Companies employing an Android app developer to develop peer-to-peer apps earn money from fixed-rate payments with borrowers. These payments are an unspecified percentage of the loan amount paid to both the creditor and the borrower.

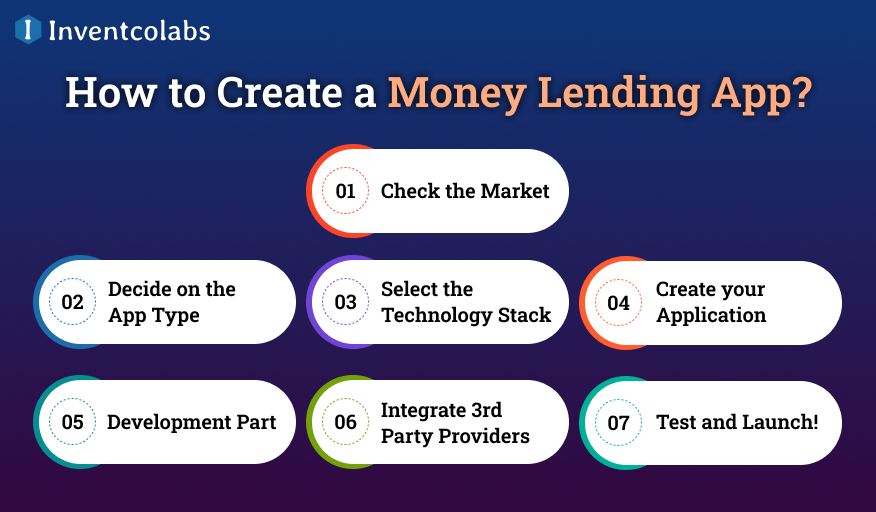

How to Create a Money Lending App?

Then, we tackled the most important question: “How do I develop a money-lending app?” Here are the most important steps to take for Loan Lending App Development.

If you need assistance at any of these points, don’t hesitate to contact us, and we’ll gladly offer you a consultation.

>Check the Market

Check out other lending applications and note their strengths and weaknesses. Try some of them to gain firsthand knowledge. In addition, you can watch loan app review clips on YouTube. Be sure to check out the comments section! You will find valuable feedback from customers about their experiences. You should do this homework to provide more information about the market you’ll be joining.

>Decide on the App Type

Following market studies, consider the most essential features you’d like the loan lending app development to have. You can then go back to the cash landing types block to decide which app you can and intend to build. For instance:

- App for money lending to get cash advances

- App for money lending to help with small personal loans

- Business money lending app that allows loans

Due to numerous factors, such as the cost of app development and team outsourcing services, the future features of your app will depend on its kind. At this point, sketching your current plans and developing your ideas into an attainable and realistic design is essential.

- Create a group

- If you’ve got an approximate idea of how you will start a Loan Lending App Development Company, you can choose your group to discuss working methods more deeply. In essence, you will have four choices here:

- Work with freelancers and contractors;

- In-house takeaway;

- Employ an outsourcing firm;

- Sign a contract with an agency for local development.

Every team type is different in terms of cost, beginning with freelancers as the cheapest option and lending to an agency for development as the most expensive. Opting for an outsourcing company is the best option for the cost, development speed, and quality. Read the complete guide on locating app developers for your application and how it can benefit your business.

Explore More: Money Lending App Development Cost, Types, Tech Stack, And Features in 2024

>Select the Technology Stack

Now, we’re moving to the next step. Consider your website’s infrastructure and the technologies required to be integrated to make it safer and more scalable. These are the main things your team must be working on:

- app infrastructure;

- Frontend and backend development

- Database management

- UI/UX design

Although a money lending application isn’t a banking institution, it uses private customer data, and therefore, security should be considered a top priority. Users’ data should be secured both at rest and during transit. The best security methods to safeguard your systems from unauthorized access are recommended. Data backup, tracking, penetration testing, and more are needed.

>Create your Application

While a great design may bring in little money, a design could create a buzzkill for the intended audience. Keep the interface minimal so that your app is simple to use. Additionally, think about including gamification. It could be beneficial when users earn credits!

>Development Part

The creation of a money-lending app requires several software creation tasks:

- Frontend development concentrates on creating the user interface. This involves developing and implementing the app’s layout, menus, buttons, and other elements that users interact with. This frontend design team also designs app websites using techniques like HTML, CSS, and JavaScript.

- Backend development concerns the app’s server side, where the information and logic are stored. This involves developing the schema for databases and creating APIs that enable the application’s front end to communicate with its back end. Backend developers typically employ programming languages like Python, Ruby, or Java and database management systems such as MySQL.

Ultimately, the creation process for a money lending application involves a mix of frontend and backend design and creates an easy-to-use, reliable, secure, and effective platform for managing loans and financial transactions.

>Integrate 3rd Party Providers

As lending app development involves various financial processes, integrating third-party software and tools is crucial. Consider integrations with payment gateways like PayPal, Stripe, bank cards, e-wallets, and accounting systems.

The app developer needs to connect your mobile app to the required tools using set APIs. Review everything that has to be connected, as the tools and applications will affect the app’s functionality and security.

>Test and Launch!

When you accomplish the above mentioned steps, you should test your lending application to verify how it looks and performs. If it runs smoothly, then you can put it on the marketplace. In the meantime, be attentive to every review you receive and make any necessary adjustments if required.

Online Services That Loan You Money

Online lending platforms are the most reliable source for Bespoke loan lending app development because they allow you to apply for a loan from multiple lenders simultaneously without causing any harm to the credit rating.

The lenders will then compete with you for your business, and you could receive several loan offers from which you can choose when you’ve completed the loan application and are approved — which usually takes less than an hour the time to receive the loan’s proceeds in the shortest time possible on the next day of business.

>MoneyMutual

MoneyMutual has led the way in locating short-term Loan Lending App Solutions for people with poor credit. It has one of the most extensive networks of lenders available on the web, so it is possible to find a loan for various credit types, each with an affordable cost of borrowing, interest rates, and monthly payments.

When you join a company with a relationship with the most significant number of lenders, you’ll boost competition among lenders. This means you’ll receive only the most competitive offers that fulfill your financial needs. A large network also improves the chances of finding an institution to help you with your poor credit score.

>24/7 Lending Group

The 24/7 Lending Group is an online lender network. You can apply for a loan utilizing your mobile device and check with several lenders who are willing to accept your information based on the details you supply.

After you’ve selected the loan deal you like, you’ll be taken to the lender’s website to finish the application. Funds from the loan should be transferred to the account within 24 hours of approval.

>CashUSA.com

CashUSA.com offers a more substantial installment loan that enables you to pay back your debt over time with a monthly installment that suits your budget. Every online lender who is a partner with the network will accept requests from people with poor credit scores and can give you the loan you need within under 24 hours.

The time it takes to repay the loan will depend on your offer and the lender from which it originates. A smaller loan amount does not allow for longer repayment terms.

>SmartAdvances.com

SmartAdvances.com will lend you money today or tomorrow. The pre-approval process takes less than a minute, and then you’ll be contacted by the lender directly to finish the loan application.

The number of loans and repayment terms vary from lender to lender. However, to be eligible for a loan, you must earn at least $1000 monthly and meet other requirements.

>BadCreditLoans.com

BadCreditLoans.com frequently offers loans to those who need approval through a bank credit union. The website provides a quick loan application that takes no more than five minutes and won’t impact your credit score.

You must complete your loan application on the lender’s website if eligible. After that, you’ll be credited with money within the next business day.

>CreditLoan.com

CreditLoan.com states that it will help you find the right lender to satisfy your loan needs, even if you have a poor credit score. Although you’re not sure of receiving a loan offer once you have submitted a Loan Lending App Development, the company has a long-standing track record of success to back its assertions.

So, you’ll stand an excellent chance of getting a competitive offer even if you have an upcoming bankruptcy on your credit record.

>InstallmentLoans.com

InstallmentLoans.com is a different lending platform that helps borrowers get loans as much as $5,000 regardless of their credit score. These loans can be paid back in weeks or months according to their loan offers.

When granted an installment loan, you can repay it in regular monthly installments rather than making the entire payment when your next payday comes around.

>PersonalLoans.com

Personal Loans.com helps you discover personal loan deals that don’t require upfront funds or collateral to be approved. These installment loans also let you pay off your debt using monthly payment options that don’t strain your budget.

Some lenders enable you to extend the loan for 72 months (six years). This could lower your monthly payments and make the loan less expensive.

Explore More: Loan Lending Mobile Application Development – Complete Guide

Cash Advance Apps That Loan You Money

It is worth looking into an app for cash advances when you need a tiny amount of money to cover the next payday. The apps can send qualified applicants up to $500 until your next paycheck arrives.

Be sure to distinguish these apps for cash advances from cash advance loans. Both have very short repayment times and provide low loan amounts. These apps won’t charge you a high rate of interest on the loan that you require.

>Dave

The Dave app is a huge success, with millions of mobile app downloads from users who wish to open an online bank account and apply for cash advance loans between paydays when they require quick cash.

With a bank account, you’ll receive direct deposit payments up to 2 days sooner than if you get a check delivered by mail. You can also get up to $100 cash advances at no cost.

>Earnin’

Earnin is a pay advance application that allows you to connect your account with a checking account and an electronic timesheet at work for quick direct deposit advances prior to payday.

You can choose the amount you’d like to pay for the service, with the option of a zero-tip tip. New users get a maximum of $100 for their advance on their pay period. As time passes, you can raise your limit to $500.

>Possible Finance

The mobile application Possible will create your account and then process your loan request in only a few minutes. An applicant who meets the criteria can use a loan of up to $500, with repayment due on the next payday.

Possibly doesn’t check FICO scores to determine eligibility. In its place, the loan provider analyzes your employment history and pay schedule to decide whether to accept or decline loan applications.

>Cash App Borrow

You might already have a Cash App installed on your smartphone, but you must realize it lends cash to those who qualify. It can loan you up to $200 and offers the option of a four-week repayment period and a 5 percent monthly cost. This feature isn’t accessible to most App users.

The loans will require a thorough credit report from the credit bureau. It will show up as a credit check on your report. There are no hidden charges.

>Even

Even the app’s members can save over $100m in interest and fees related to credit, overdrafts, and loans through the application’s Instapay feature.

This feature lets employees get their wages if they’re in cash shortages before payday. Members can also use Instapay for free, although the company could charge for cash advance loans.

>Brigit

Through the Brigit mobile application, it is possible to connect a checking account with a checking account that is eligible for regular direct deposit payments and receive $250 of cash advance payday funds for free.

The app analyzes your direct deposit history to determine the amount of money you typically deposit and the amount of money you are eligible for before the next payday.

>MoneyLion

MoneyLion goes beyond an app for payday advances. The all-encompassing service offers its users mobile bank accounts, credit-building loans, investment products, and credit score monitoring.

The Loan Lending App Development Company isn’t subject to charges; you could need to pay a charge to receive your funds promptly. Delivery and processing are free. An 18-to-48-hour timeframe if you’re depositing funds from the loan into a RoarMoney account. It can take up to five days before receiving the funds in a checking account that is not an external one. For $3.99, it is possible to have your money immediately in a RoarMoney account. Delivery to an account with a checkbook or debit card is $4.99.

Explore More: Why Build a Loyalty App to Boost Customer Satisfaction in 2024?

Conclusion

The Loan Lending App Development has recently increased as there is an enormous demand from those looking for simple loan options instead of visiting the bank and enduring difficulties.

With the growing popularity of Android phones and iPhones and the increasing demand for money-lending apps, a variety of Android service providers, along with iPhone application development services, are focused on applications for money-lending development.