Leading Loan Lending App Development Company

Looking for a loan lending app idea for your finance business? At Inventcolabs, our team of loan lending application developers builds interactive loan lending apps to provide you relevant solutions for your business needs. Allow your customers to get access to all types of loans with the help of a custom-made loan lending application from our experts. Hire our mobile loan app development services now!

Loan Lending App Solutions

Whether it is about commercial lending or personal loans, or a private institute loan, the loan lending app solutions that we deliver can help in providing personalized experiences. Our loan system custom application allows the lender to get access to all loan-oriented products and services.

Our Work Process

Ideation

We get a detailed understanding of the app idea of our clients to come up with relevant plan for the solution

Project Specification

Based on your idea, we come up with specifications for the mobile app development project

UX/UI Design Phase

Going with your specific requirements, we come up with professional UI/UX design ideas to drive business success.

Development Phase

Our expert developers collaborate and work with different teams through the transition phase to get the best results.

Testing

We perform in-depth auditing and testing to deal with the performance lags and bugs to keep it vetted for quality at all levels.

Launch

Upon successful completion, we ensure a smooth launch of your product and keep it an impressive affair.

Why You Choose Our Loan Lending App Development Services?

Inventcolabs has garnered immense respect and reputation from its clients through top-class customized mobile app development solutions. We have satisfied clients from all across the globe. We are adept at delivering performance-driven, top-quality apps that serve your customers well.

- Fast Development

- Cost Effective

- 100% Quality & Safety Compliance

- Post-Production Support

Want to hire a resource to work with you?

What Our Clients Say About Us

Over 150+ Satisfied Clients And Growing

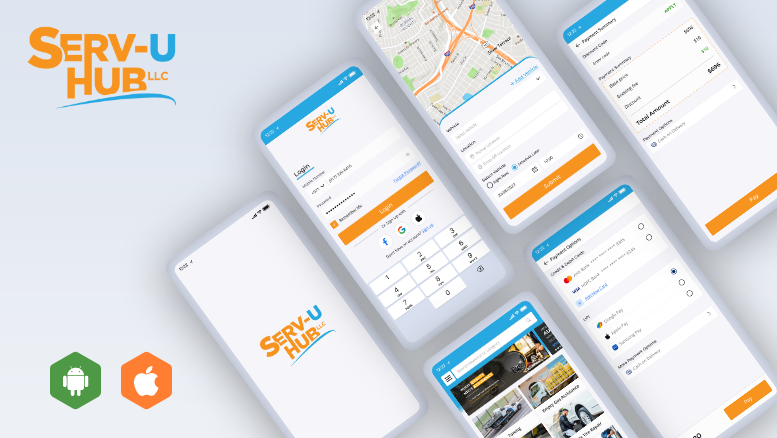

Their commitment, expertise, and attention to detail have truly exceeded expectations.

CEO and Founder

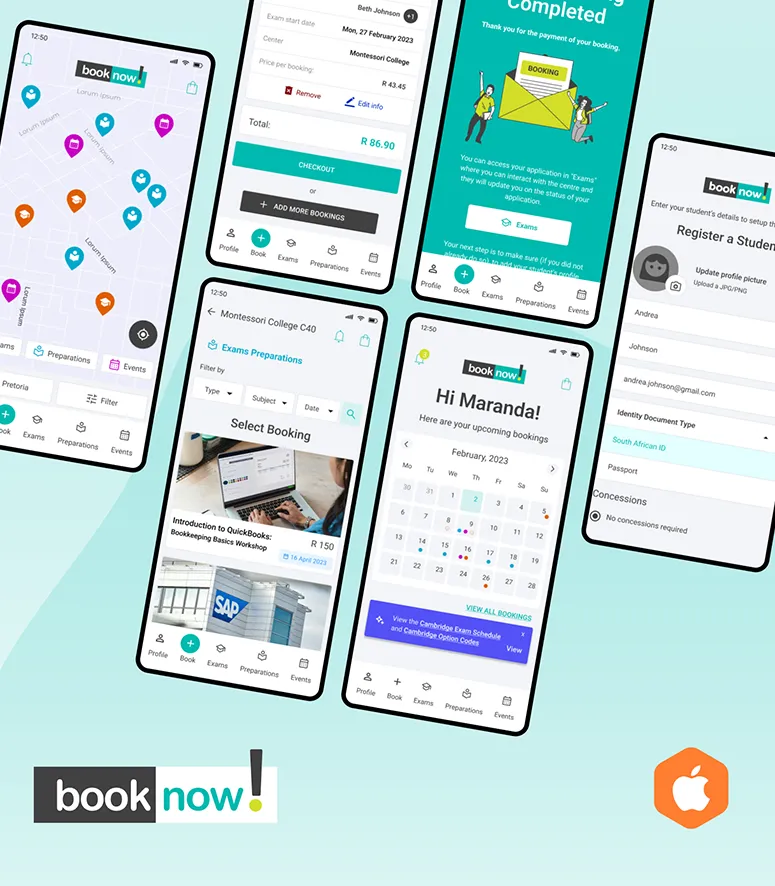

Serv-U Hub LLC

Mobile App Development for Roadside Assistance

Serv-U Hub LLCMr. Shakeim Reid

East Orange, New Jersey, USA

Project Summary

Inventcolabs provided mobile app development services for a roadside services company. They built the app, made it compatible with Android and iOS, and integrated customer-interaction features.

Project Date

July 2023 - Jan. 2024

Project Budget

$50,000 to $199,999

Inventcolabs team is professional, responsive, and extremely knowledgeable. They always take time to understand our vision and execute it flawlessly.

CEO and Founder

Dunnnit Challenge

Mobile App Development for Dunnnit Challenge App

Dunnnit ChallengeMr. Branko Radovic

Abu Dhabi, United Arab Emirates

Project Summary

The Dunnnit Challenge app lets users set 30, 60, or 90-day challenges in Mind, Body, Spirit, and Creativity, with community engagement, gamification, rewards, and exclusive merchandise for successful completions.

Project Date

Sept 2024 - Ongoing

Project Budget

Confidential

Inventcolabs delivered the app on time, earning positive remarks from the client. They were responsive and communicative via Skype and email. Customers can expect a team that can offer quality work at a reasonable cost.

Executive Manager

Religious Platform

Mobile App Dev for Religious Platform

Religious PlatformMr. John Park

USA

Project Summary

Inventcolabs developed a mobile app for a religious platform. The team built both an iOS and Android version of the app.

Project Date

Apr. - July 2023

Project Budget

Less than $10,000

Inventcolabs meets my expectations and is developed what I’ve requested. I recommend working with Inventcolabs if you want to replicate something similar to what I’ve done with this project. They’re responsive and quick to address the client’s changes and fix development issues.

Owner

Shortlet Rental

Mobile App Development for Booking Company

Booking CompanyMs. Adeyinka Akeju

Lagos, Nigeria

Project Summary

Inventcolabs has developed a mobile application for an online booking company. The client has asked Inventcolabs to replicate their website’s design and functionalities, which are booking vacation properties.

Project Date

Aug. 2022 - Ongoing

Project Budget

$10,000 to $49,999

It has been an extremely smooth experience to work with Inventcolabs. For me as a non-technical person who knows nothing about the web, you guys have been ‘friendly experts’. Amazing SPOC to work with.

Founder

Online Food Delivery Company

Mobile App Development for Online Food Delivery Company

Online Food Delivery CompanyMr. Ackerley

Seattle

Project Summary

An online food delivery company hired Inventcolabs to provide mobile app development. They created a food delivery app for Android and iOS using Flutter and also provided marketing services for the platform.

Project Date

Aug. 2021 - Jan 2022

Project Budget

$10,000 to $49,999

Inventcolabs was proactive, caring, and easy to work with, meeting the client's expectations and satisfying their needs. They make sure to meet our demands.

CEO

The Perfume Smell

Web & App Dev for Perfume Company

The Perfume SmellAshish Mod Patel

Kuwait

Project Summary

Inventcolabs helped a perfume company develop all the customer-facing technology behind their business, including an app and a website.

Project Date

Aug. - Dec. 2022

Project Budget

$50,000 to $199,999

Team Inventco helped me to build a mobile platform for iOS and Android from scratch. They delivered exactly what was needed on time, leaving me completely satisfied with the collaboration. Inventco's response time was really good and their team was technically sound. Would highly recommend them.

Franchise Owner

Director, Yaduvanshi Fitness Club

iOS & Android Development for Fitness & Wellness Company

Yaduvanshi Fitness ClubMr. Ravindra Yadav

Gurgaon, India

Project Summary

Inventcolabs provides mobile app development services. The team Inventco helped me to build a mobile app for IOS and Android from scratch.

Project Date

Sep. 2022 - Jan. 2023

Project Budget

$10,000 to $49,999

I've been thoroughly impressed with Inventcolabs humility and willingness. They consistently delivered work on time and exhibited a genuine dedication.

Founder

Ronaldo Biotech

SEO, SMM, Content Creation & Marketing for Medicine Company

Ronaldo BiotechAnurag Gupta

Jaipur, India

Project Summary

Inventcolabs provides digital marketing services for a medicine company. The team implements strategies involving SEO, social media marketing, content creation, email marketing, and online advertising efforts.

Project Date

June 2023 - Ongoing

Project Budget

$10,000 to $49,999

Frequently Asked Questions

This is because you can hold us accountable for whatever we will deliver has been put to paper –without any additional cost. We are completely transparent and impose no hidden charges.

At Inventcolabs, we have a comprehensive range of app support and maintenance services. We make sure that we remain responsive to all your requests even after the launch of the app.

Have a great app idea?

Bring it to the floor before your competitor does!Latest Blogs And News

Stay updated with the latest development insights, technologies, trends.

Top 10 Popular Banking Apps Like Albert

Money management is an important task that seems quite challenging for most people. A single bad step can lead to a complete mess. The presence of a mobile banking app like Albert can help the users to make things a little bit easier.

Tax Planning Software Development: Features & Process

The financial environment is very particular regarding accuracy, speed, and legal issues, especially taxes. Comprehending taxation laws, regulations, and schedules still challenges most firms and people.

Mortgage Calculator App Development: Features & Process

Smart financial tools are now integral in today’s digitized world and are in high demand. Regardless of whether one is buying a new house or is just seeking for a home loan refinance, the total mortgage payment needs to be estimated correctly.

How To Create A Money Transfer App: Step-By-Step Guide

Creating a money transfer app is a popular business venture in the digital world due to the growing demand for seamless and instant send-money solutions. Users now seek such apps to send money online to friends or family for various reasons, such as making international money transfers that are quick, secure, and hassle-free.

How to Develop A Financial Fraud Detection Software Using Machine Learning?

Financial fraud is regarded as one of the most significant threats that current institutions have to deal with. This means that with the fast-growing use of digital transactions, online banking, and mobile payments, fraud has become more rampant.

AI Stock Trading App Development – Cost and Feature

Over the years, financial markets have been most dynamic in terms of embracing technological advancements. Artificial Intelligence (AI) has positively impacted stock trading, making it more efficient, accurate, and accessible than ever.

How the Right Loyalty Program App Is the Key to Success?

Maintaining customers and build in how the Right Loyalty Program App Is the Key to Success loyalty is essential for any successful company in the current business environment. Technology has shifted the way businesses view client loyalty, and the best loyalty program is becoming a necessary element of this approach.

Loan Lending App Development: Understanding Costs and Essential Features for Success

Finding the appropriate app developer to create your loan lending app may seem impossible when you need to know what to look for during this process. Experience in app creation is key here; someone with this specialization must know how to design something appealing that also functions well.

Top Money Lending Applications in the USA and Why People Use them in 2024

When borrowing money, it is possible to obtain it at any bank. They can lend you substantial money at a particular interest rate or even offer you credit cards for your everyday use. In any case, many users often use these efficient services.

Why the Right Loyalty Program App Is the Key to Success in 2025

As businesses grow, they put much effort into keeping the company afloat by focusing on acquiring new and retaining existing customers. Small businesses, SMBs, and enterprise-sized companies understand the importance of loyal customers.

Mobile App Strategies To Grow Customer Loyalty In 2024

As customers become increasingly demanding and fickle in today’s aggressive and cutthroat marketplace, customer retention becomes even more vital.

Money Lending App Development Cost, Types, Tech Stack, And Features in 2024

The market for tax filing apps is a multibillion-dollar industry. It is anticipated to reach a remarkable rate of $13.2 billion by 2027. The rise in demand for fast and easy-to-use services can be linked to the growing use of mobile devices. Examine the ever-changing market for the best mobile tax filing applications like TurboTax, where users’ tax filing experience is being revolutionized by robust technology and user-friendly UI.

How To Develop An App Like TurboTax : Cost & Features

The market for tax filing apps is a multibillion-dollar industry. It is anticipated to reach a remarkable rate of $13.2 billion by 2027. The rise in demand for fast and easy-to-use services can be linked to the growing use of mobile devices. Examine the ever-changing market for the best mobile tax filing applications like TurboTax, where users’ tax filing experience is being revolutionized by robust technology and user-friendly UI.

A Comprehensive Guide of AI’s Impact on Banking – Benefits, Use Cases, and Inspiring Applications

The financial sector, which is undergoing a significant change right now, is significantly impacted by Artificial Intelligence (AI). Artificial Intelligence (AI) can be likened to a technological wizard that helps financial institutions such as banks operate more efficiently.

Mobile Banking Application Development: How to Create Mobile Banking App?

Mobile banking has revolutionized the way we manage our finances. Gone are the days when you had to visit a bank branch to deposit a check or transfer money. Today, you can do all these and more, right from your smartphone.

Loan Lending Mobile Application Development – Complete Guide

We live in a digitized era. The modern era is filled with ongoing technological advancements. Innovations keep taking place all around the world. All such innovations are achieved by integrating state-of-the-art tech machinery and improved application systems.

Our Offices

QATAR

Office 201, 20th Floor, Tower B,Al-Marina Twin Towers,

Lusail, Doha, Qatar

Whatsapp Us : +91-94600-42348

INDIA

71/99 Opp. KV#5, Paramhans Marg,Mansarovar, Jaipur

Rajasthan, India

Call Us : +91-94600-42348